Data and trends in tapes for the European building & construction industry

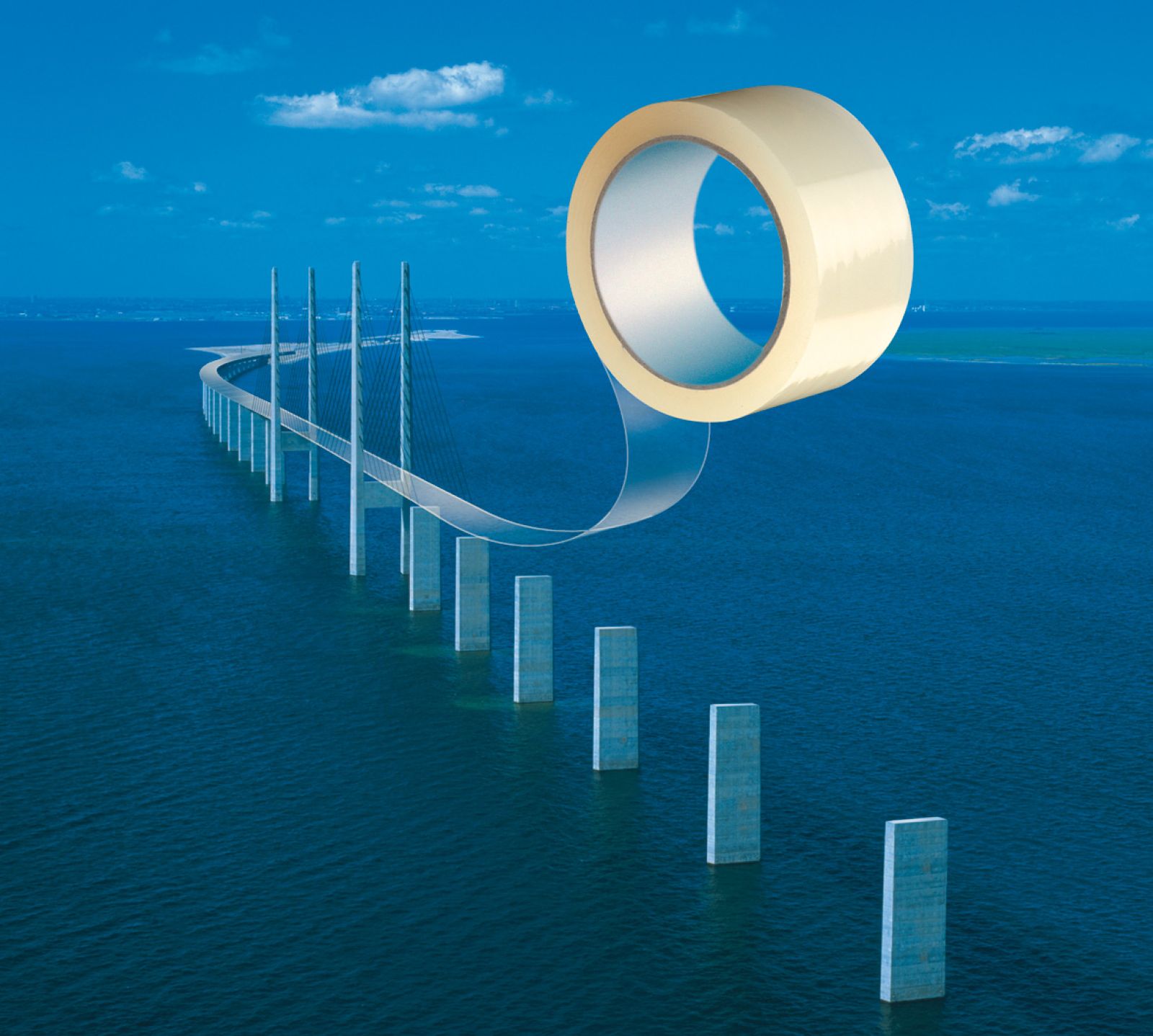

“The reason for using tapes in B&C should be made more visible,” began Mr. Smit. “They are easy-to-use, lightweight, cost-effective, durable and make things look better.” 2 presentations covering adhesive tapes in the building and construction markets of Europe and the U.S. topped Afera’s Working Programme at our recent Lisbon Conference. Evert Smit, Afera president & head of global R&D at Lohmann GmbH & Co., KG, first provided an interesting overview of the European B&C tape market, which has an expected CAGR of 2.5% from 2018 to 2021.

“The reason for using tapes in B&C should be made more visible,” began Mr. Smit. “They are easy-to-use, lightweight, cost-effective, durable and make things look better.” 2 presentations covering adhesive tapes in the building and construction markets of Europe and the U.S. topped Afera’s Working Programme at our recent Lisbon Conference. Evert Smit, Afera president & head of global R&D at Lohmann GmbH & Co., KG, first provided an interesting overview of the European B&C tape market, which has an expected CAGR of 2.5% from 2018 to 2021.

According to AWA Alexander Watson Associates in its latest Global Specialty Pressure Sensitive Tape Market Study, general adhesive tape demand is growing faster than global GDP at 3.8% over 3.4% in 2019, so tapes are gaining market share worldwide. In Western Europe in 2020, tape production will rise modestly, i.e. 1.7% to 8.4 billion square metres. Rebounding construction activity will increase the use of masking and other tapes. Western Europe still has the market edge with specialty tapes, producing 1.3 bsm or 20% of the world’s total in 2019. 5% of the world’s specialty tapes are produced for the B&C market. 24% of these are produced in Europe.

Tapes are suitable in a wide range of building applications, conformable to a strongly regulated market

Many tapes for B&C come in forms that you might not necessarily think of as tapes. Top uses for tapes include applications in home energy efficiency, moisture and air management. Recyclability and extreme temperature resistance are important. Applications include marketing paint lines, masking, humidity barriers and house wrapping/building envelop.

Many tapes for B&C come in forms that you might not necessarily think of as tapes. Top uses for tapes include applications in home energy efficiency, moisture and air management. Recyclability and extreme temperature resistance are important. Applications include marketing paint lines, masking, humidity barriers and house wrapping/building envelop.

“The future of the B&C industry will probably be ‘smart houses’, in which everything in your home is integrated,” said Mr. Smit. The mission is co-ordinating the construction and electronics industries. “I see this as an opportunity for tapes as they are growing in use in both sectors.” ‘Tiny houses’, which introduce a completely different way of building a dwelling, are a rising niche trend in the U.S. that he feels the tape industry can get a jump on in terms of creating specific tape applications which can make their construction faster and 100% energy efficient.

“Although you see the U.S. market utilising more B&C tapes, true innovations in this area are coming out of Europe,” Mr. Smit continued. In Europe, tapes in B&C applications have been in use for decades, but they have only played a significant role in U.S. B&C for the last 10 to 15 years. Currently about 1/3 of all projects in B&C specify tapes, and Mr. Smit sees this growing as most users would like to switch away from liquid adhesives and pastes for reasons of efficiency, cost and tightening regulatory requirements.

“Although you see the U.S. market utilising more B&C tapes, true innovations in this area are coming out of Europe,” Mr. Smit continued. In Europe, tapes in B&C applications have been in use for decades, but they have only played a significant role in U.S. B&C for the last 10 to 15 years. Currently about 1/3 of all projects in B&C specify tapes, and Mr. Smit sees this growing as most users would like to switch away from liquid adhesives and pastes for reasons of efficiency, cost and tightening regulatory requirements.

Drivers for using tapes in the European B&C industry: Added functionalities in tapes may be the clincher

E.U. safety and environmental regulations

E.U. safety regulations in B&C are growing in number, complexity and stringency, covering construction, renovation and demolition and also including raw materials selection, exposure to chemicals and air quality. E.U. environmental legislation also includes energy consumption, recycling and re-use of building materials. Mr. Smit cited the example of The Edge, which is the most sustainable office building in Amsterdam at energy neutral.

“At the end of the day, the requirements set by law and builders will be passed on from our customers to us,” warned Mr. Smit. “So we need to know the rules and work according to these.” What’s more, the legislative landscape in the E.U. basically makes it a level playing field for European companies but not for non-E.U. members. Whatever the case may be, tapes can contribute to meeting safety and environmental measures in the form of non-solvent, low-VOC and/or energy-saving varieties.

Shifting European demographics

Shifting E.U. demographics are overwhelmingly dominated by a relatively wealthy, ageing population, as well as a younger population working increasingly remotely and commuting less. This is greatly affecting the types and styles of residential and office buildings in demand. A shortage of suitable housing and manpower, rising house prices, and pressure on building speed and raw materials prices is “opening the door to new technologies, including tapes.”

New construction technologies including tapes

New construction technologies including tapes

“The European B&C industry is very conservative and price-driven,” Dr. Smit emphasised. “But in the current climate, I see a lot of room for incorporating extra application functionalities in rolling adhesive tapes into the market.” Despite the need for change in a growing market sector, the more experienced the B&C project/product specifiers, the more conservative they are. Establishing new systems and technologies can take years. Influencers across the industry will be key in shedding light on product cost per unit versus cost in use, both areas in which tape can create real value. Furthermore, the highest cost in B&C is labour, which is in short supply, and tapes increase efficiency in use.

What does this mean for tape manufacturers?

- Tapes are a new bonding technology and are thus at a disadvantage. Creating real-world test methods and significant amounts of data will demonstrate the longevity of adhesive tape bonding solutions. According to Mr. Smit, ASTM and DIN TMs and standards, as well as UL listings, are insufficient in the market. Real experience with products and materials counts.

- “Influencers” are increasingly important: Endorsements of other users and tape trade organisations create familiarity and often tip the balance in favour of tapes.

Educating customers so they understand the value that tapes can provide to their products is important. “We are doing this in Europe, and I see associations like Afera and the PSTC playing a key role here.”

Educating customers so they understand the value that tapes can provide to their products is important. “We are doing this in Europe, and I see associations like Afera and the PSTC playing a key role here.”- Where tape is a true part of the design (e.g. in HVAC), it has to last the lifetime of the product. Sometimes targets are too rough. Poor design is often a problem, so working with designers is critical in advancing the use of tapes.

Download the complete slide presentation of Evert Smit (Members only)

Go to overview of Lisbon Conference topics

Learn more about Afera Membership