Corporate Sustainability Due Diligence Directive (CS3D)

What is CS3D?

The Corporate Sustainability Due Diligence Directive (CS3D) is an E.U. initiative aimed at promoting sustainable and responsible corporate behaviour by mandating companies to identify and address adverse human rights and environmental impacts within their operations and value chains.

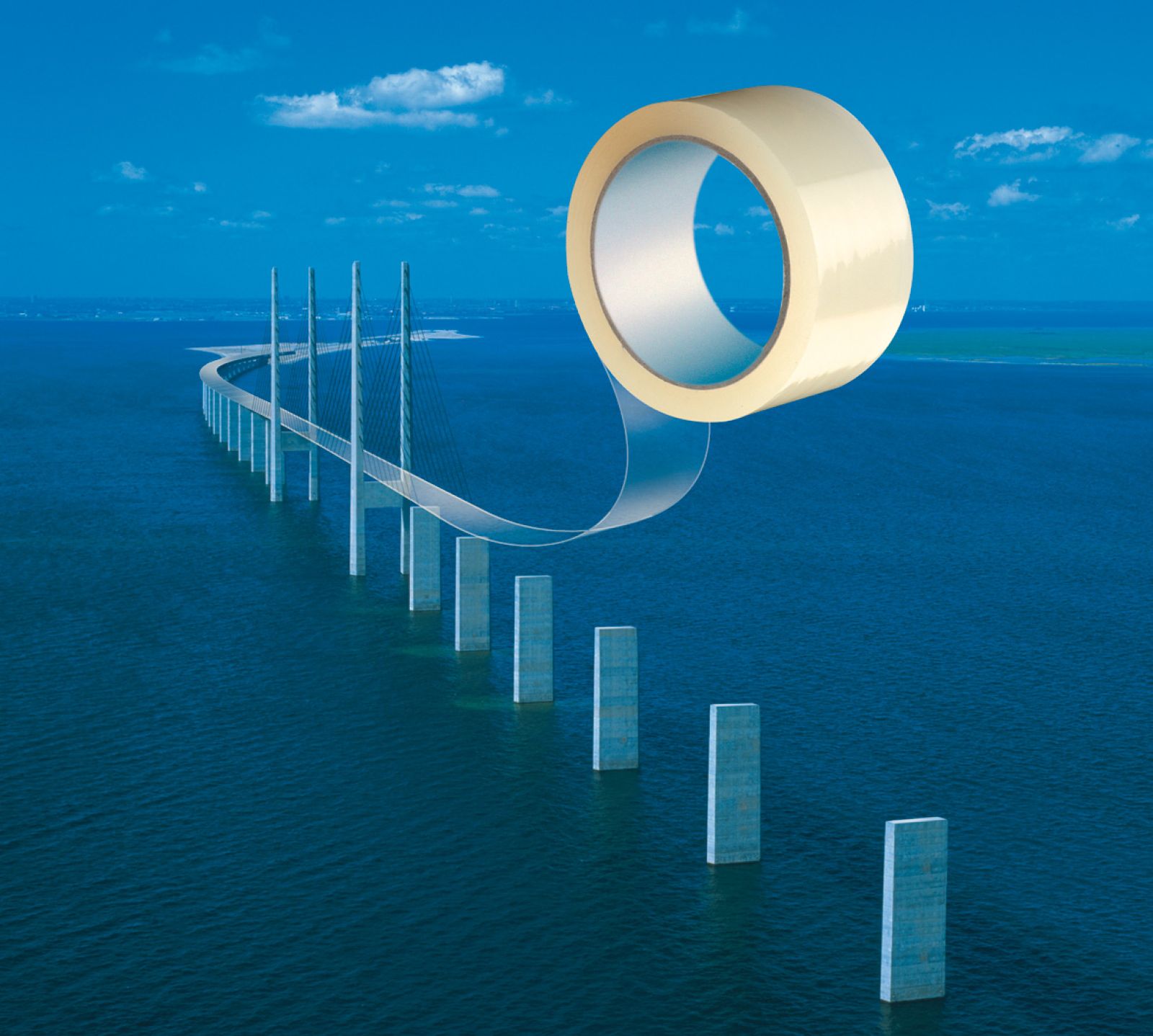

The CS3D introduces a mandatory sustainability due diligence framework that will significantly impact adhesive tape manufacturers, suppliers and exporters to the E.U. Companies must track and verify supplier compliance, reduce environmental footprint and ensure fair labour practices in their sourcing. Those that adapt early with sustainable materials, verified supply chains and low-carbon production will gain a competitive advantage, while non-compliant businesses risk financial penalties, supply chain exclusion and reputational damage. Now is the time for adhesive tape businesses to strengthen ESG strategies and integrate CS3D-aligned due diligence processes.

Primarily large adhesive tape businesses (LLCs with >1,000 employees and >€450M revenue) will be affected:

Supply chain due diligence obligations

Adhesive tape production relies on petrochemical-based adhesives, synthetic films (polypropylene, polyester), and natural rubber-based components. Companies must evaluate their entire supply chain to ensure compliance with human rights and environmental standards, particularly for raw materials like natural rubber, petrochemicals and adhesives. Suppliers must provide transparency on labour conditions, sustainable sourcing and regulatory compliance, or risk exclusion from E.U.-based supply chains. Key impacts:

- Rubber sourcing: If using natural rubber adhesives, companies must ensure their suppliers comply with sustainable forestry standards (e.g. FSC certification).

- Petrochemical-based adhesives and plastic films: Suppliers must prove compliance with emissions reduction policies and ensure no human rights violations in manufacturing (e.g. in Asian markets).

- Paper-based tapes: If producing gummed paper tapes or fibre-based adhesives, companies must check that wood pulp sources follow E.U. deforestation regulations.

- Coatings and solvents: Adhesives and coatings often use chemicals regulated under REACH. Companies must verify suppliers meet E.U. chemical safety and worker protection standards.

Environmental and carbon footprint accountability

Under CS3D, companies must reduce greenhouse gas (GHG) emissions across their operations and supply chains. For adhesive tape businesses, this means:

- Energy-intensive production: Many tapes require heat-intensive coating and curing processes. Companies must document emissions from manufacturing and set emission reduction targets.

- Solvent-based adhesives: Businesses will need to phase out high-VOC adhesives and shift towards solvent-free or water-based adhesives.

- Sustainable material development: Increased demand for biodegradable, recyclable or compostable adhesive tapes (e.g. PLA or bio-based adhesives) to comply with corporate sustainability goals.

Risk of business loss for non-compliance

Failure to implement CS3D-compliant due diligence may result in exclusion from E.U. supply chains, affecting contracts in packaging, automotive, electronics and medical industries. Companies that do not meet sustainability and human rights standards face legal penalties, fines and reputational damage, jeopardising their market position.

Business adaptation strategies for adhesive tape companies

To stay competitive, adhesive tape businesses should conduct supply chain audits, integrate ESG policies and transition to bio-based adhesives and solvent-free solutions. Aligning with certifications (e.g. FSC, ISCC) and implementing supply chain transparency measures will help ensure compliance and secure long-term partnerships with E.U. clients.

Status of legislative process

Due to the new scope of the regulation (adopted text: LLCs with >1,000 employees, >€450M revenue), most Afera Members are out of scope; however, stakeholders who supply the LLCs may be affected. On 26 February 2025, the European Commission proposed an "Omnibus package" aimed at simplifying and aligning sustainability reporting and due diligence requirements. This package includes amendments to the CS3D, such as postponing its application to 2028 and raising the thresholds for company applicability to more closely align with the Corporate Sustainability Reporting Directive (CSRD). This may give adhesive tape businesses more time to implement due diligence while shielding many smaller firms from direct compliance. The revised focus on direct suppliers simplifies compliance for companies by reducing deep-tier supply chain burdens, but businesses must still ensure transparent sourcing, ethical labour practices and environmental responsibility. The Omnibus changes are currently proposals, and until formally adopted, the original CS3D schedule (and existing national due diligence laws) still loom.

Timeline of measures and actions

- 23 February 2022: The Commission proposed the CS3D, aiming to establish mandatory human rights and environmental due diligence obligations for companies operating within the E.U.

- 5 July 2024: The CS3D is published in the Official Journal of the E.U., making it an official legal act.

- 25 July 2024: The directive enters into force, starting the countdown for Member States to transpose its provisions into national law.

- 26 February 2025: The Commission proposed an "Omnibus package" aimed at simplifying and aligning sustainability reporting and due diligence requirements.

- 26 July 2026: Member States are required to transpose the CS3D into national law (within two years of its entry into force).

- 26 July 2027: The largest companies, specifically those with over 5,000 employees and a net turnover exceeding €1.5 billion worldwide, must comply with the CS3D requirements.

- 26 July 2028: Companies with over 3,000 employees and a net turnover exceeding €900 million worldwide must comply with the directive.

- 26 July 2029: Companies with over 1,000 employees and a net turnover exceeding €450 million worldwide must comply. Additionally, companies engaged in franchising or licensing agreements with a turnover exceeding €80 million in the E.U. and royalties exceeding €22.5 million must comply.

- 26 July 2030: The E.U. is mandated to review the directive and submit a report, potentially accompanied by legislative proposals, to the European Parliament and Council.

- Afera’s RA-WG is looking into the stakeholder information which might be required by the LLCs.

References

- Just and sustainable economy – Commission lays down rules for companies to respect human rights and environment in global value chains: https://ec.europa.eu/commission/presscorner/detail/en/ip_22_1145

- Commission simplifies rules on sustainability and EU investments, delivering over €6 billion in administrative relief: https://finance.ec.europa.eu/publications/commission-simplifies-rules-sustainability-and-eu-investments-delivering-over-eu6-billion_en

- European Commission Proposal for a Directive amending Directives 2013/34/EU, 2004/109/EC, 2006/43/EC, and (EU) 2022/2464 as regards sustainability reporting, sustainability due diligence, and other rules: https://commission.europa.eu/document/download/892fa84e-d027-439b-8527-72669cc42844_en?filename=COM_2025_81_EN.pdf